As 2025 unfolds, C-level executives are navigating a landscape marked by persistent volatility and complexity. Ongoing economic uncertainty—including issues such as tariffs, inflation, and rapid technological advancements—continues to shape the decisions and strategies of organizations. In this challenging environment, how are C-suite leaders steering their companies and preparing for the year ahead?

To gain insight into these questions, we surveyed C-level executives across our communities in April 2025 to understand how geopolitical and economic dynamics were influencing their priorities (see the complete findings from April here). Six months later, we conducted a follow-up survey to see how their perspectives may have shifted. In this report, we present eight key findings from 740 C-level executives who participated in our August survey and examine how their views have changed over time.

Finding 1: Changing Sentiments on the Economic Climate

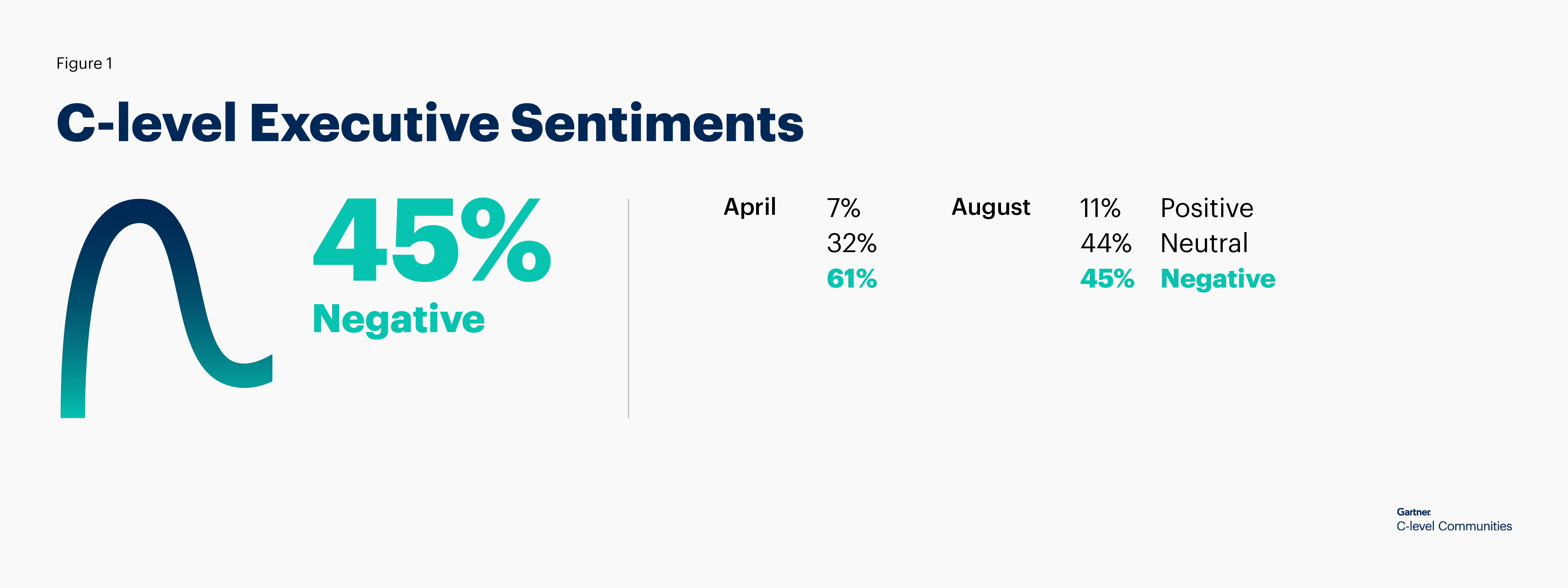

Overall, C-level executives now express a more neutral—and less negative—view of the geopolitical and economic environment and its impact on their organizations compared to earlier this year. Executives responding that their sentiments on the current climate are negative dropped from 61% in April to 45% in August, and those answering “neutral” increased from 32% to 44% in that time.

There are some slight variations from the average among different roles in the C-suite, with CHROs articulating a slightly more negative view (52% negative) and CISOs having a higher percentage with a neutral sentiment (49%). CIOs expressed sentiments similar to the overall average with 46% having a negative view and 41% with a neutral view.

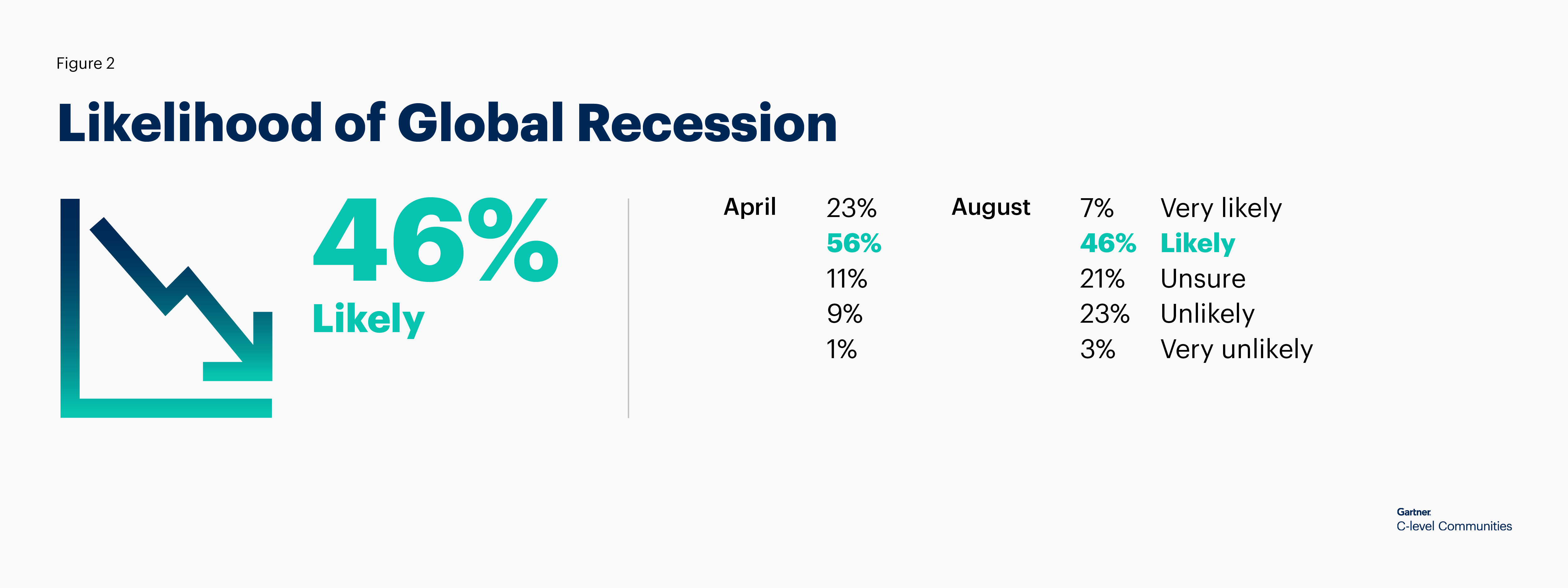

In addition, C-level leaders are less pessimistic about the possibility of a recession. In April, a combined 79% of C-suite leaders said a recession was likely (56%) or very likely (23%). Now, executives have changed their thinking, and 53% believe a recession is likely (46%) or very likely (7%). The percentage of executives who are unsure has increased from 11% to 21% in that time.

Finding 2: Signs of Workforce Challenges

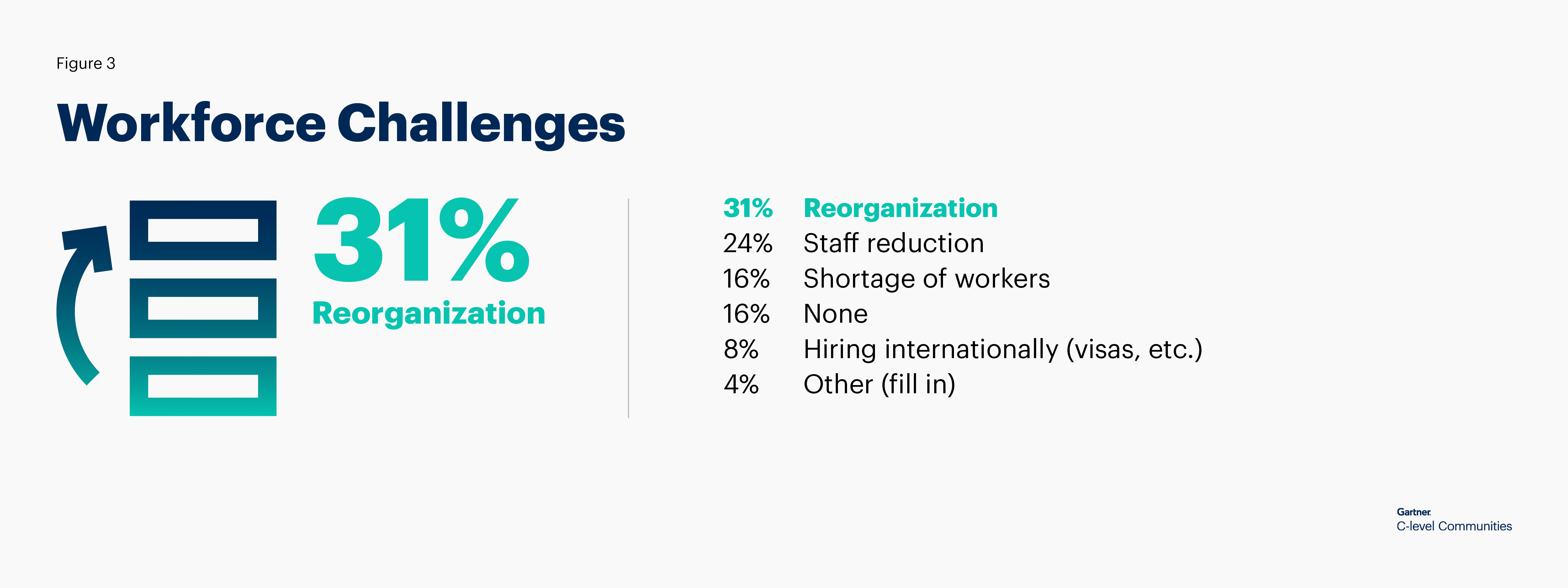

Despite the overall shift in their sentiments, C-level executives reported workforce challenges in response to a new question in the August survey. When asked what, if any, challenges their organizations were facing, 31% of executives said they are reorganizing, and 24% responded they are reducing staff. Sixteen percent reported they were facing a shortage of workers, and the same percentage (16%) said they had no workforce issues.

Finding 3: A More Upbeat Outlook for the Future

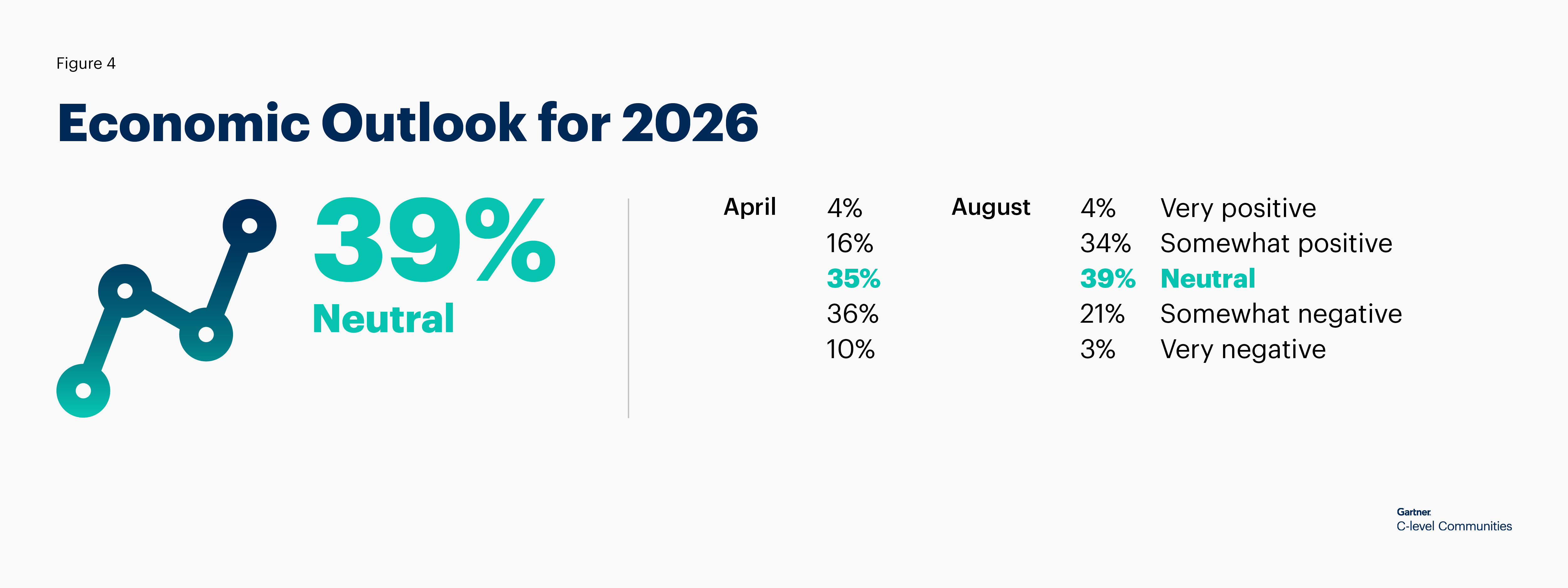

When asked about their thoughts on the economy as we head into 2026, C-level executives remain neutral, with 39% saying they are neutral in August, up from 35% in April. However, the percentage of executives with a negative outlook decreased from 46% (somewhat or very negative) to 24% now. The percentage with a somewhat positive outlook also increased from 16% to 34% between April and August.

Planning for the Future

In the open-ended survey questions, we asked C-level leaders how they are strategizing for 2026 amidst the complex and ambiguous environment. Flexibility, agility and scenario planning were common themes for all executives, but there are some nuances among the C-suite roles. Below we outline the key areas of focus for each role as they try to build organizational resilience despite ongoing uncertainty.

2026 Planning for CIOs

While 28% of CIOs report they are prioritizing investments currently to manage through a volatile environment, their outlook for the future leans neutral to positive. Thirty-eight percent of IT executives have a very positive (5%) or positive (33%) outlook for 2026, and 37% describe their views as neutral.

When we asked how they are planning for 2026 in the current environment, their responses fell into three areas:

- Agility, flexibility and scenario planning

- Operational efficiencies, cost optimization and a focus on value

- Investments in technology and talent

Here is a sample of CIO responses on how they are planning for 2026:

We are challenging ourselves to use existing technologies to deliver increased value, identify how to disrupt ourselves and make improvements to our execution.

Remain agile, develop scenarios and alternate plans and preparations, create risk mitigation plans and preparations and limit lock-in or long-term commitments.

The same as always – focus on the projects with the highest expected rates of return for the organization. Perhaps we are less willing to take on riskier projects, and we are more focused on eliminating waste.

Keep an eye on the industry and try to use a more agile budget planning approach to allow as much flexibility over the next 12 to 18 months.

2026 Planning for CISOs

Nearly 70% of CISOs have maintained a focus on their key priorities this year despite the volatile environment. For security leaders, their predominant view of 2026 is neutral with 40% of respondents describing their outlook that way. A positive view closely follows at 38%, while 23% of CISOs have a negative outlook on 2026.

In terms of planning for 2026, CISOs’ responses fall into three categories:

- Agility, scenario planning and risk-based prioritization, with an emphasis on flexibility in security planning

- Alignment with the business strategy and regulatory requirements

- Operational efficiencies, strengthened foundational controls and technology enablement

Here is what CISOs had to say about their planning for 2026:

Stick to the essentials – ensure appropriate controls are in place to protect the business.

Refocus on minimizing spend, while ensuring we are covering everything we need to do.

Focus on spending – how do we do more with the same or less and implement all the relevant functionality we purchased in our security suite.

Connect the security strategy and strategic goals to the business strategy. Do more scenario planning and risk assessments to help better planning and preparedness.

2026 Planning for CHROs

Among the C-suite roles we surveyed, CHROs had the highest percentage of executives who shifted their top priorities this year at 35%. Another 19% of HR leaders were in the midst of adjusting their priorities. Even with these shifts, CHROs lean positive in their outlook for next year, with 46% saying they are very positive or positive, 33% neutral and 22% reporting a negative view.

Here are the main areas of focus for CHROs as they strategize for 2026:

- Adaptive leadership, agility and scenario planning

- People-centric strategies, including skills, engagement and culture

- Operational efficiency, strategic alignment and resilience

Here is a sample of how CHROs describe their approach:

We are building our 2026 strategy around scenario planning, building organizational resilience and adapting our people processes.

We are keeping a very keen eye on our budgets and determining if the changes we have made or are making are having an impact.

Shift from rigid planning to adaptive leadership. Our strategy needs to be resilient and responsive.

Scenario planning and frequent reviews of investments to accelerate or pull back relative to observed environmental and business factors.

2026 Planning for CDAOs

When it comes to Chief Data and Analytics Officers (CDAOs), more than half have stuck to their original priorities during the year (56%), and they are mostly neutral (53%) on their outlook for 2026. In terms of how they are thinking about next year, data leaders are in line with their C-suite peers in focusing on caution and agility.

The top focus areas for CDAOs from the survey include:

- Risk management and cautious investment

- Efficiency, cost optimization and agility

- Data, AI and core value propositions

Here are a few responses from CDAOs on how they are planning for next year:

By continuing to focus on mid-range strategic priorities and minimizing distractions when possible.

AI is the constant even in the environment that we are in. We know AI will continue to evolve, and data is the fuel for AI needs.

Doubling down on the core value propositions of data. Ensuring data and analytics activities are driving value. Looking for AI opportunities as a response to staff shortages and policy impacts.

Progress with quick decision-making based on known data, while also maintaining an open mind to pivot as quickly and efficiently as the landscape shifts.

2026 Planning for CFOs

Of the C-suite roles we surveyed, CFOs had the highest percentage of executives who did not shift their strategies during the volatile environment of 2025 at 81%. Their thinking on the possibility of a recession is also the least pessimistic, with 58% saying a recession is very unlikely or unlikely.

Similar to their C-level peers, CFOs are focused on developing contingency plans and remaining cautious about spending. Their 3 main focus areas for 2026 are:

- Scenario planning and stress testing

- Core strategies and values

- Conservative and flexible financial planning

Here is a sample of responses from finance leaders on strategies for next year:

Budget to cover the worst case scenario with flexibility to improve if the subsidy outlook improves.

We continue to ground ourselves in our values and goals, while making tactical corrections to spending and investment.

Our strategy remains the same, but we are more actively creating scenarios and developing contingency plans.

We plan with different scenarios, trying to find the best possible of them to build our budget for the next year.

Executives across the C-suite are strategizing for 2026 by prioritizing agility and scenario planning, focusing on core operations, managing risk and finances conservatively and leveraging technology–especially AI. For more data from the August survey, check out our infographic, and for detailed insights from earlier this year, read our survey report.

If you are a C-level leader who would find value in validating your strategies with peers, apply to join a local community. Or, if you are already a community member, sign in to the Gartner C-level Communities app to find an upcoming opportunity to connect with like-minded peers.

Based on 740 responses to Gartner C-level Communities’ Community Pulse Survey, August 2025.

Join a Community

Find your local community and explore the benefits of becoming a member.